1. Assess Your Financial Situation:

Before going straightforward for searching the Bank for fulfilling your personal loan needs, first of all there are some points that you need to keep in mind. Consider the following:

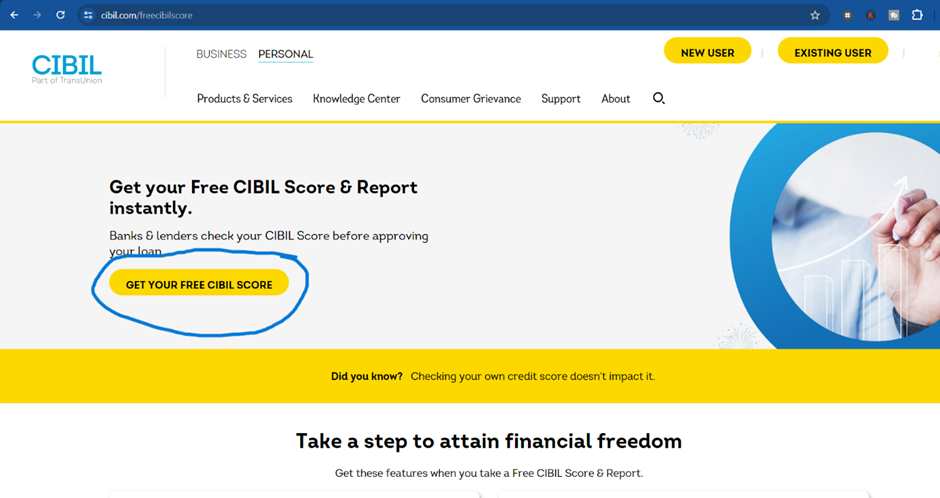

- CIBIL/Credit Score: First of all, you should know how much is Your credit Score? Credit Score or we can say Your CIBIL score both are the same. Your credit score significantly impacts your loan eligibility and interest rate. Higher CIBIL scores will get you Lower Interest rate on your personal loan, higher tenure for repaying your personal loan and also your personal loan will be sanctioned on better terms and conditions. So, if you are not aware of your credit Score then you can Check the same following these steps : Step No (1) Create your account on CIBIL website Using this link : https://www.cibil.com/freecibilscore

and click on Get your FREE CIBIL Score. This will take you to a page wherein you have to create the account. Now, after creating the account you need to click on the top right corner Existing user- Then Click on Individual. There you need to fill your ID and Password that you have created. Then the page will show your CIBIL Score.

- Income and Expenses: Now review your monthly income against your expenses to determine how much you can comfortably afford to repay each month. This is a very important step since most of the Buyers do not actually look at their monthly expenses and chooses a personal loan which are Higher in interest and Lower in Tenure. Then, they find themselves paying a higher EMI which they cannot actually afford.

2. Define Your Loan Purpose

Your selections will become more limited if the purpose of your loan is clearly identified. Common purpose of loan includes:

- Paying Higher Interest Debt: Combining multiple loans into one loan with a potentially lower interest rate is a very good option. Also, this step will help you in Easy payment of One EMI rather than paying 3 or 4 EMI’s every Month.

- Major Purchases: Sometimes we take personal loan for our Sudden needs like purchasing a Latest I-Phone or Purchasing a Camera Lens etc. These demands can also be fulfilled but always ensure to take Insurance of such articles .

- Emergency Expenses: Most of the personal loans are taken for meeting an emergency Expenses like paying a medical bill or for Paying college Fees etc. So, for emergency expenses yes you can go for Personal Loans but always keep in mind the Interest rate and Terms and conditions of the loan.

- Home Improvement: Financing home renovation is sometimes a good option when the loan amount required for repairs is not too high. As we all know that home loans or home improvement loans are usually offers lower interest rate than Personal Loans.

3. Search for Financing Banks: –

Different banks offer personal loans on different terms and conditions. So, it is very important to search the Financing bank that best suites you. Consider:

- Private Banks: Traditionally Private banks like HDFC Bank, ICICI Bank, Axis Bank etc offers a higher interest rate on Personal Loans which ranges from 10% to 24 % per annum. Yes, these private banks charge higher interest rates but their processing time is usually lower than that of PSU/Govt Banks.

- PSU Banks (Govt Banks): We all know that the Govt Banks like State Bank of India (SBI), Punjab national Bank (PNB), Central Bank of India, Bank of Baroda etc offers personal loans on Lowest Interest rates. These banks offer personal loans on as low as 8.40% per annum (SBI Bank). Also taking a personal loan from PSU Bank is typically difficult as these banks demands various paperwork for the sanctioning of Personal Loans. However, in today’s digital scenario these PSU banks are also offering personal loans Digitally that is even way faster without submitting any physical documentation at your bank.

- NBFC’s (non-banking financial Companies): Often provide personal loans on Very high Interest rates and easy documentation. The famous NBFC’s in India are Bajaj Finance, Tata Capital, Aditya Birla etc. Taking a personal loan from these NBFC’s are usually easy but offers a high interest rate that goes from 14% – 36% per annum.

- Online APPs: There are various online apps available on Playstore like Moneyview, CASHe, Navi, mPokket etc which are offering personal loans through their mobile apps only. But taking a personal loan from these apps are a riskier decision sometimes since these apps offers personal loan on very high interest rates and difficult terms and conditions that is like, High pre-payment charges or not allowing borrower for pre-payment of loan.

5. Evaluate Interest Rates and Fees

The interest rate significantly affects your loan cost. These interest rates are of two types and these are:

· Fixed vs reducing Rate of Interest: Banks/NBFC’s offers personal loans on two different type of interest rates. When there is a Fixed rate of interest, the interest rate doesn’t change over the term of the loan. The entire principal amount that was originally borrowed is used to compute interest. Example: –

- Loan Amount: Rs. 10,000/-

- Interest Rate: 10% per annum

- Tenure: 3 years

Interest each year =Rs.10,000/- * 10% =Rs.1,000/-

Total interest over 3 years = Rs.1,000 * 3 = Rs.3,000/-

Total repayment = Rs.10,000 (principal) + Rs. 3,000 (interest) = Rs.13,000/-

In case of Reducing Rate of Interest: Interest is calculated on the remaining loan

balance following each repayment if the rate of interest is decreasing. With every

payment, the principal amount and the interest amount drop respectively. Example: –

- Loan Amount: Rs. 10,000/-

- Interest Rate: 10% per annum

- Tenure: 3 years

- Repayments: Monthly

Month 1: Interest = Rs.10,000/- * (10%/12) = Rs.83.33/-

Repayment = Rs.333.33/- (principal + interest)

Month 2: New Principal = Rs.10,000/- (Rs.333.33/- – Rs. 83.33/-) = Rs.9,750/-

Interest = Rs.9,750/- * (10%/12) = Rs.81.25/-

Repayment = Rs.333.33/-

This continues, with the principal reducing every month, leading to a decrease in the interest component over time.

Choosing between a fixed and reducing rate of interest depends on your financial situation and preferences. Always consider your financial goals, repayment capability, and market conditions before making this decision. BUT STILL ALWAYS GO FOR REDUCING RATE OF INTEREST.

- Fixed vs. Floating Rate of Interest: A fixed rate of interest means that the interest rate remains same throughout the loan tenure. This ensures that the borrower pays the same interest rate regardless of interest rates up and down by the Central Bank (RBI). A floating or variable rate of interest means that the interest rate can fluctuate over the loan tenure based on changes in an underlying rate of interest by RBI. Hence if Reserve Bank of India changes its Base rate, then There will be no effect of the personal loans who have taken loan on Fixed Rate of Interest but on the other side these effects the Interest Rate on loans that have opted for Floating Rate of interest. To make it clearer we can clear our doubts with an example:

- For salaried person who has fixed salary and fixed monthly obligations (Emi’s ) then they should go for Fixed Rate of interest on personal loans as if RBI increases the Base rate with Higher margin then this will definitely affect the pocket of a salaried person.

- If you are businessman or Self employed and your income is not fixed then he/she can go for either of the options. Since both options has their own advantage and disadvantages.

6. Review Loan Terms and Conditions

Carefully examine the loan’s terms and conditions, including:

- Repayment Period: A longer repayment period means lower monthly EMI but higher overall interest costs. For example, a loan of Rs. 2.00 lacs with monthly Emi of Rs. 6,000/- for a tenure of 36 Months you will pay Rs. 16,000/- as overall interest. In other way the same loan for 60 Months with monthly EMI of Rs. 4200 you will pay Rs.52000/- as Interest for whole term. So, choosing a repayment term as per your monthly income is very crucial.

- Prepayment Charges: Before taking a personal loan, you have to first check whether the said loan have any pre-Payment charges or not. Since most of the Private bank’s charges 1%-2% for pre-payment of loans during a said term and on the other side some NBFC’s even charge higher Pre-payment charges that goes upto 5% of principal amount as well. But if you go for Personal Loan at PSU/Govt banks then they can offer you personal loan on even NIL prepayment charges. Hence always choose a personal loan that offers you lower Prepayment charges for early payment of your loan.

- Processing Fees: Processing fees of personal loan ranges from Nil to 5% of loan account as well. So, if you want a personal loan on lower processing fees then you have to first approach your own bank where you are maintaining your saving/current account, because your own bank can offer you the personal loan at lowest processing fees.

7. Use a Loan Calculator

Loan calculators can help estimate your monthly payments and total interest cost over the loan term. Input different loan amounts, interest rates, and repayment periods to see which option best fits your budget. So, if you want to use the Loan calculator then you can click on this link: – https://emicalculator.net/

8. Read the Loan Sanction letter

Before signing the sanction, read the most important terms and conditions as we have mentioned above like Processing Fees, Pre-payment charges, Rate of interest, Term of loan etc. Always ensure you understand all terms, conditions, fees, and your obligations. Don’t hesitate to ask the Bank for clarification on any points.

Conclusion

Choosing the best personal loan involves careful consideration of your financial situation, loan purpose, and thorough comparison of various options. If you find any difficulty in choosing a personal loan for you then you can also TAKE THE FINANCIAL GUIDANCE FROM FUNDSGURU as we are professionals working in the same line of field from last more than 15 years. Thank you for your patience reading and do share the article with your friends and family so that they can Choose the BEST PERSONAL LOAN FOR THEMSELVES!!

FUNDSGURU

For more info, you can also contact us on : Info@fundsguru.in